Welcome! Let's dive in.

3 smart things about money and finance.

Thanks for signing up! The big point here? To share significant news about money that just about anybody can use. Stuff you can chew on as well as things you can use.

1. “I was wrong.”

What a great place to start. Treasury Secretary Janet Yellen cried foul on herself this week to CNN. Last year, she was preaching about the limited impact of inflation. Fast forward to today’s cosmos-level gas prices and stiff hikes on just about everything else.

“There have been unanticipated and large shocks to the economy that have boosted energy and food prices and supply bottlenecks that have affected our economy badly that at the time I didn’t fully understand.”

No disrespect. We all make mistakes. Get too magical in our thinking. Start looking for rainbows in the middle of hurricanes. But the Secretary of the Treasury is supposed to be different. She’s supposed to have special insight, her own looking glass that guides us with a view the rest of us can’t see.

Are we at least at the eye of the storm?

Yellen reported that “core inflation” has dropped (that’s a measure that doesn’t include the price for food and energy.)

“We’re looking at steady and stable growth and bringing inflation down,” Yellen said.

What’s the takeaway? Things will be better. Prices will come down. And we all have feet of clay.

2. Cash is king. And queen.

Amazing story at Bloomberg about the very real efficacy of cash payments to Americans in need. The story tracks a group of women in Jackson, Mississippi, who were living on the edge when the pandemic struck. Following the same principles of federal pandemic relief, the Magnolia Mother’s Trust grants $1,000 a month to mothers for a year, no strings attached, letting them spend it however they see fit.

“The Magnolia Mother’s Trust initiative builds off a simple idea: that cash is the most efficient and most effective way to help people in need. It’s an old concept, but one that got legs during the pandemic, partly because of how effective cash payments were at buoying low-income Americans over the last two years.”

Most of the women in the Magnolia Mother’s Trust describe using their grant money to build their savings — and the relief that comes with a small cushion in the bank. Car repairs, school supplies and everyday groceries weren’t a constant worry. And best of all, the experience of reliable, sustained income incentivized them to seek out jobs with higher pay.

That’s a long-term boost that sticks long after the Win, win, win.

3. The kids are alright?

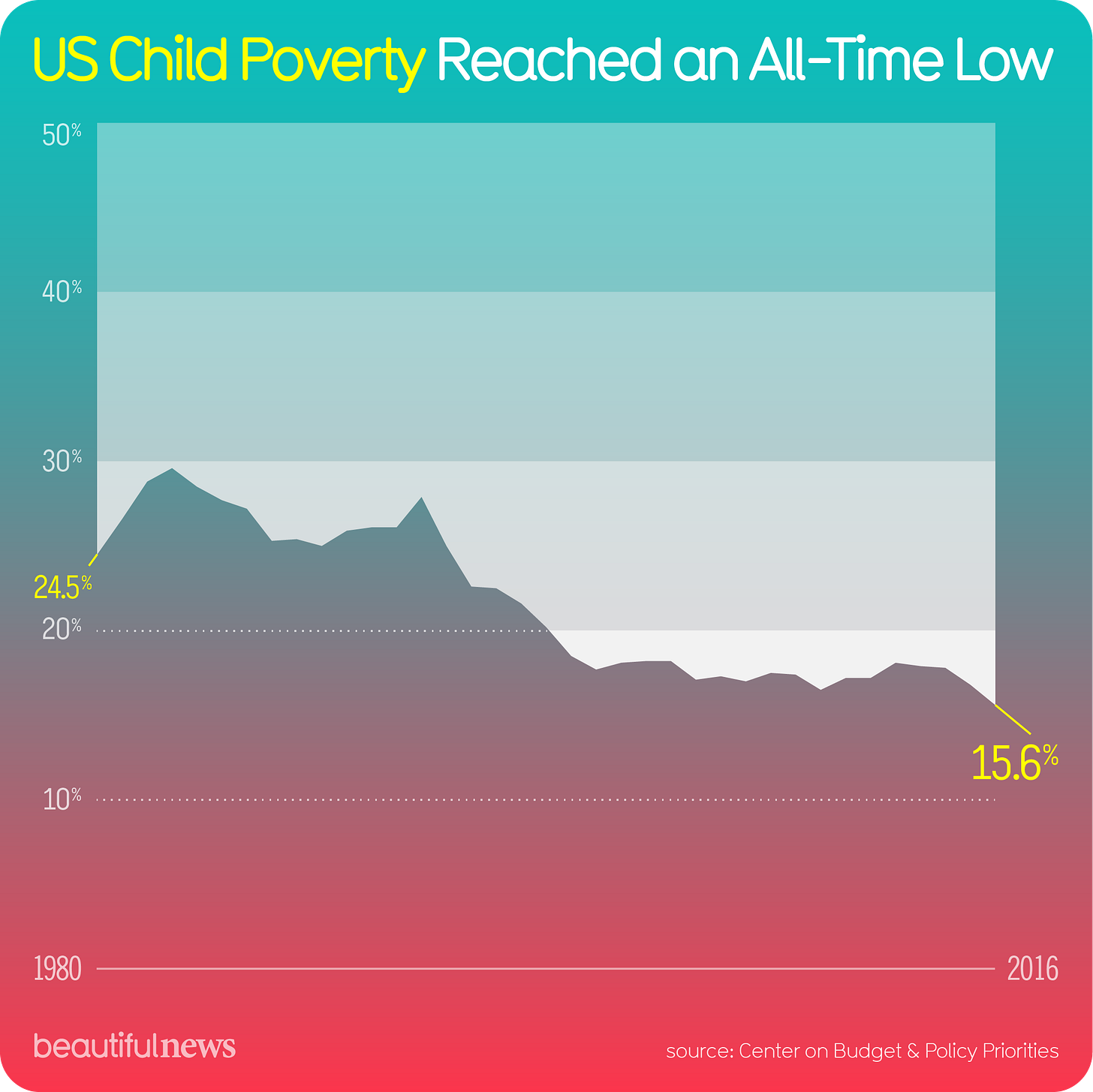

Child poverty is a big problem in the US, bigger than in other high-income nations. But we’re headed in the right direction. In the last 60 years, we’ve halved the rate across all racial and ethnic groups.

Advocating for government aid is not the main focus of this newsletter. Promise. But that’s the big lesson behind the nice headline: “In 2018, $233 billion more was spent on low-income children than in 1980.” As a result, kids are growing up healthier, with a better shot at success.

Keep it simple.

See what we’re up to here? A few straight-forward bits to help shape how you think about money.

You must be ready for more…